If you’re an aspiring Amazon seller, odds are you’ve watched hour after hour of how-to tutorials showing every step of the Amazon FBA process. From product research to sourcing, ordering samples, and shipping. Looks easy, right?

But as the old saying goes, the first step is usually the hardest.

I hear it all the time.

“Setting up a business and LLC is intimidating. Do I really need to do that?”

“I can’t wait to start selling! I just have to set up my LLC first…”

“Amazon’s going good…but I’m still stuck on the LLC thing….”

Believe me, you’re not alone. But setting up the LLC doesn’t have to be stress-inducing, especially if you know what you’re getting yourself into.

What is an LLC?

LLC stands for Limited Liability Company. In simple terms, it’s a business structure that protects your personal assets if legal issues arise in your Amazon business.

For example, let’s say a customer sues you for selling a faulty or dangerous product. If you’ve formed an LLC, they won’t be able to go after your house, property, car, or other personal assets.

LLCs (and their equivalent) are used by businesses all around the globe as a form of asset protection.

But believe it or not, despite being a relatively simple process, registering an LLC and getting your seller central account verified is what stops the majority of would-be sellers dead in their tracks.

I get it.

An LLC is the starting point of your Amazon journey. You’re putting your business on the government’s “grid,” so to speak, with even more annoying taxes. It’s often your first business purchase, giving you that “no turning back” feeling.

It can be pretty heavy. But after six years selling on Amazon, I can confidently say to never start an online business without an LLC.

The following is meant to inform, educate, and help with the mental-stress of getting past this first step.

Attention Residents of California! Unfortunately, most of this won’t apply to your Amazon business. California has unique rules regarding LLCs in other states. Check out this guide for more information.

Why Should I Invest in an LLC if Amazon Doesn’t Require It?

An LLC is important for a few reasons, but mainly;

- It protects your personal assets in the case that you get sued for business reasons.

- They allow for pass-through taxation, meaning any profits you make in your LLC will ‘pass through’ to its sole member (you) or members. If you’re the sole member of your LLC, you’ll simply pay taxes on your earnings as if it were your personal income, despite being earned in your business. Easy peasy.

Forming an LLC is just good business. I think of it as an insurance policy for my personal assets (an inexpensive one).

How Do I Set Up an LLC?

There’s several options.

For U.S. residents, start by Googling your state’s LLC requirements. The fees and application process will be unique to each state.

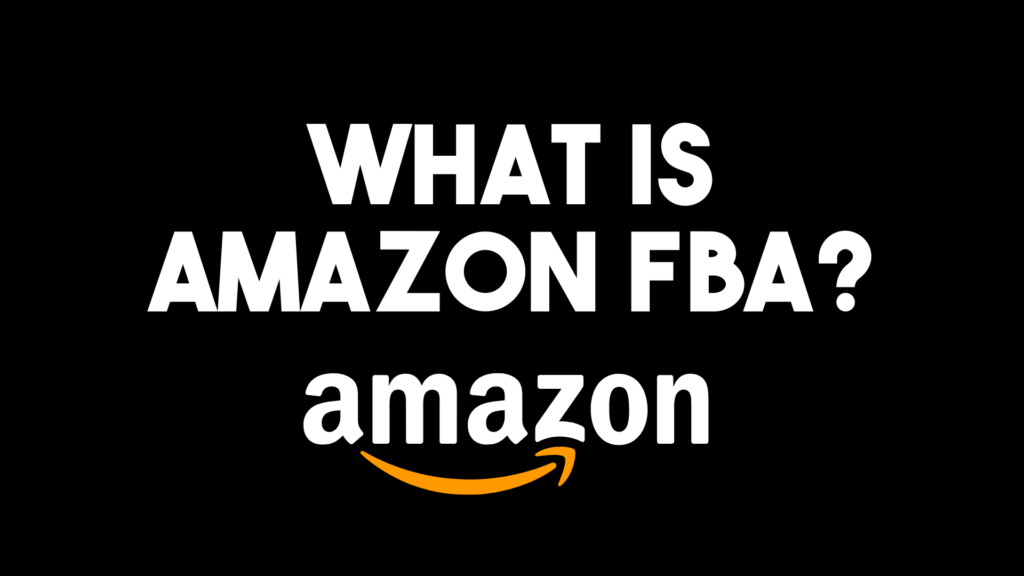

Online services like LegalZoom are available to do this for you, but I actually recommend a different route.

For an online business, it’s possible to set up your LLC in a different state than your residency.

I’ve set up several LLCs in Wyoming and Delaware, as these are two of the business-friendly states to do so in. This is called registering a foreign LLC (even if you’re a U.S. resident), and is what I recommend for clients in my Amazon Winners Academy mentorship.

However, this might cause additional taxes depending on your state of residency. While Wyoming doesn’t tax residents or businesses on their income, other states are governed by unique tax code and laws.

For International sellers doing business in the U.S.,I recommend Delaware Business Incorporators, as they have a few add-ons that could potentially help with account verifications or suspensions.

I Live in _____________, Why Set Up an LLC in Wyoming or Delaware?

You don’t have to. In fact, setting up an LLC in your home state might very well be the best option for the majority of sellers.

The reasons I choose to form LLCs elsewhere are:

- It doesn’t matter where I’m at. If you’re like me, and move or travel frequently, it can be a hassle being away from your permanent address. My registered agents receive my mail, which they scan and email to me. If you’re looking to run your Amazon business from abroad, an online registered agent’s my recommendation.

- It’s all automated and easy. As you drive deeper into your Amazon business, trustworthy services that reduce your day-to-day tasks are vital to succeed. An online registered agent gives me way less things to worry about, and more time to focus on my actual businesses.

Note these points are for a 100% online business. If you’re reading this and plan on a brick-and-mortar business, or if your LLC will require any accreditation on your part, I recommend diving deeper into the laws and requirements.

I’ve Heard Some Wyoming Registered Agents Websites are Associated with Scams, Is That True?

No, but I can see how it sounds like one. Allow me to explain.

First, having a registered agent is required by law in most places in the U.S. The agent is effectively the contact point for the business. They’ll notify you of incoming mail, and stay on top of legal and governmental procedures that may impact the business.

That being said, online services like Wyoming Registered Agents and Delaware Business Incorporators are legitimate companies with great services. I’ve had terrific experiences with both and have only heard positive reviews from my clients and colleagues.

However, bad actors do take advantage of these states’ relaxed business protocols, and as a result, a few of these businesses have received negative press.

But trust me, there’s nothing to worry about.

It’s a double edged sword. On one hand, these services are fantastic for serious e-commerce entrepreneurs like myself. The ease of setup and lack of paperwork is exactly what a lean-running online business needs; plus it allows for ease of travel if you run your business on-the-go or are a digital nomad.

On the other hand, they’re also easy for bad actors to use for the exact same reasons. And they’re without a doubt being used by deceitful Amazon sellers to run scams.

Such headlines can be misleading. They’re written to make the agencies themselves look fraudulent, which doesn’t appear to be the case. However, I do read these headlines and stay up to date with the going-ons since these agencies are part of my business.

My LLC is Brand New; Will This Raise Any Flags When Signing Up for Amazon Seller Central

Yes, it might.

While it’s hard to be 100% certain, Amazon’s AI tends to favor LLCs, business bank accounts, and credit card statements that aren’t hot off the press.

But why?

The assumption is creating new accounts and signing up to Amazon immediately afterwards is likely what a scammer would do. As a result, Amazon sometimes considers the LLC’s or account’s age to make sure this isn’t the case.

Online searches of the topic will reveal to wait anywhere from 30-60 days before trying to upload documents for account verification, but the truth is nobody really knows. Non-technically speaking, it’s a crap shoot.

I recommend trying regardless of your LLC’s age. If they require further verification, and you’re serious about selling on Amazon, you’ll be fine.

My Name’s Not Attached to my LLC, Will This Be a Problem?

The great thing about Wyoming Registered agents, for example, is anonymity. This means your phone number, name, and address won’t be visible online, which in turn protects you from fraud, scam calls, and junk mail.

This is completely fine for Amazon purposes, and you shouldn’t run into any trouble.

Will An LLC Make My Taxes More Complicated?

Despite sounding complicated, setting up and managing an LLC is relatively straightforward. You’ll need to stay organized and remember a few key filing dates and reports to fill out, but your registered agent will help remind you of those.

So while owning an LLC won’t complicate your taxes per say, running a business will.

My recommendation is hiring an accountant. This is especially true as you begin to scale and increase profits. But in all honesty, I don’t dare attempt my taxes without the help of a professional. They’ve been integral in running my Amazon business. Plus they’re a tax write-off; it’s a win-win.

Just make sure to stay organized; save all receipts, invoices, business-related purchases, software passwords, and financial statements. They’ll come in handy around tax season.

Good luck!

Ready to Start Selling on Amazon?

My Amazon Winners Academy (AWA) mentorship guides you through the entire Amazon FBA process and provides a community of support with others on the exact same journey.

AWA gives you a much-needed safeguard from costly mistakes, dead ends, and failed product investments to get you to your passive income goals efficiently.

So whether it’s solving issues with your Seller Central account, creative approaches to product research, scaling to new markets and niches, validating product ideas, customer service issues, and more, we’ve got you covered.

Learn more about it here.