Increased food prices, stagnant wages, and historically high rent prices have left many Canadians pondering ways to earn extra income.

And with the fear of a recession on the horizon, it’s more important than ever to consider ways to diversify one’s income streams.

That’s why more Canadians are turning to e-commerce, and using services like Fulfillment by Amazon (a.k.a. Amazon FBA) to grow their monthly income, and stay one step ahead of the rising cost of living.

And the best part?

Canadians are not limited to selling only in Canada!

Luckily, Amazon FBA allows Canadians to expand their business into other North American marketplaces, paving the way for endless business opportunities within the platform.

So whether you’re new to e-commerce, or an already established Canadian seller looking to sell south of the border, the following guide will help you through the process.

Amazon.com vs. Amazon.CA

Amazon.com and Amazon.CA may seem similar at first glance, but it’s important to understand the difference.

Amazon.com is the company’s main marketplace and is used by those selling in the United States. Because the U.S. marketplace is more established and robust, there’s without a doubt more competition.

However, that also means greater opportunities for higher monthly revenue and higher overall sales volume.

Amazon.CA is the Canadian equivalent, and is used specifically for Amazon goods purchased and sold within Canada.

While there’s plenty of market potential on Amazon.CA, especially if you’ve fine-tuned your research skills, there’s much higher sales volume in the American marketplace.

| Did You Know? According to a 2021 report from Innoval, Canada ranked as the world’s 8th largest marketplace for Amazon purchases. The U.S.A. Ranked #1. |

What is a North American Unified Account?

If you’re a Canadian, American, or Mexican citizen, you’re given the option to sell in all three countries’ marketplaces upon starting an Amazon Seller Central account.

This is known as a North American Unified Account. Unified accounts give individuals the ability to streamline inventory management between the three countries.

The clear advantage here is having automatic access to sell in Amazon’s American marketplace, and these types of accounts aren’t available elsewhere in the world.

Setting Up a Corporation in Canada for Amazon FBA

Canadians looking to sell on Amazon should first set up a cooperation.

Cooperations are legally-established entities that separate a business from an individual.

Cooperations can enter into purchasing contracts, own assets, sue, and be sued.

So why should you set one up?

Establishing a corporation isolates you, the individual, from any legal repercussions experienced through your business.

So whether it’s selling on Amazon FBA, or starting an exotic new food truck, setting up a corporation safeguards your personal assets (i.e. home, vehicle), from your business assets.

And depending on your yearly profits, it may be required by law by the Canadian government.

| Did You Know? Canadian Businesses making over $30,000 CND are required to register for Goods and Services Tax/Harmonized Sales Tax (GST/HST) |

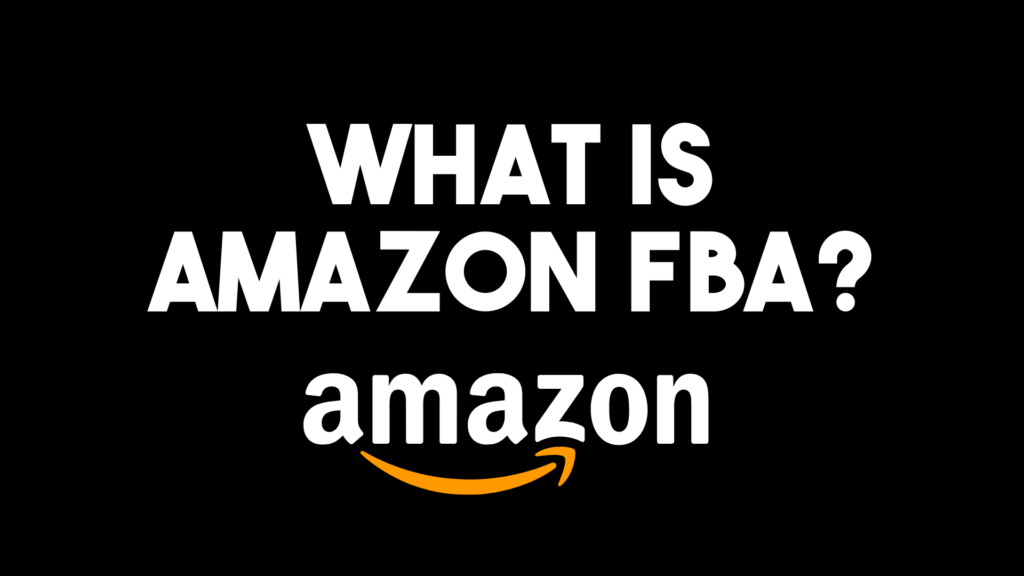

Canadians Signing Up for An American EIN Number

After you’ve set up your Canadian cooperation, you’ll need to sign up for an EIN number through the U.S. government’s IRS website.

But first, what exactly is an EIN Number?

For tax purposes, the American government needs insight into all commerce taking place within its borders. EIN numbers are effectively, social insurance numbers (social security if you’re American) for businesses, and are used by the U.S. to collect owed taxes.

Of course, clicking through a U.S. government website can be intimidating (even if you’re from the U.S.)

But it’s all part of the process, and this step is straightforward.

Apply for an EIN number here.

| What About U.S. and Canadian Taxes? Adhering to all tax protocols when selling internationally is tricky. While there are tax advantages for Canadian cooperations doing business in the U.S., I highly advise consulting a cross-border tax expert when dealing with taxes in this regard. |

How Should I Set Up My Banking?

Canadians selling in the U.S. marketplace will require a cross-border bank account.

This type of account is best for Canadians who consistently earn U.S. dollars, or spend a large amount of time in the United States.

But what’s the advantage?

Well, in addition to being required, cross-border banks accounts allows Canadians to set up banking in both USD and CND.

This is important, as getting the best exchange rate and lowering banking fees can skyrocket profits when selling products in the U.S. from Canada.

I recommend TD Bank, which has locations in major cities of both countries.

Alternatively, there’s also Wise (formerly known as Transfer Wise). The app, which is available for download via Google Play or Apple Store, allows for easy and cheap money conversions with limited fees.

What Products Should I Sell on Amazon in the US?

Choosing a product to sell on Amazon is easier said than done.

I tend to use research apps like Helium 10 to get me started.

Still, there’s much to consider when choosing a product to sell:

- Product Weight

- Current product Trends

- Shipping method

- Time of year

- Trustworthiness of Suppliers

- Margins

- Country of Origin

And while there are countless ways to approach product research, it’s really a matter of trial and error.

Best of luck!

Are you interested in creating a self-sustaining e-commerce business through Amazon FBA, but worried about making costly mistakes with your hard-earned investment?

Click here to learn more about how my Amazon Winners Academy program has helped countless sellers earn up to $30,000 USD per month in Amazon sales without losing it all on failed products.